With Instant Payment System (IPS) enabling QR code payments at its full swing in Serbia, Pink Taxi has partnered with Payten on another pioneering project aiming to bring superb experience to its customers through innovation. The customers of Pink taxi can now pay for the service in a totally cashless way via QR code using just “IPS Scan” option within their mobile application, which makes this taxi company the first of its kind on the local market that offers such a possibility. It is expected that this type of payment will soon be introduced in all Pink taxi vehicles.

The project allows instant payment that requires only a QR code generated within the taxi driver’s application, which is scanned by a customer using their mobile application. The application used by Pink taxi has been commissioned by the Serbian Chamber of Commerce (PKS) and developed by Payten as well as certified by the National Bank of Serbia (NBS). The main goal of cooperation between the Serbian Chamber of Commerce and Payten has been to encourage cashless payments and provide support to SMEs.

In an earlier project with Pink taxi, Payten implemented mPOS, a mobile payment solution, which enables merchants to transform their smartphones or tablets into mPOS systems that fully support PIN based transactions and QR code payments under the new regulation introduced by the National Bank of Serbia (NBS). For the purpose of this project, no additional investment in the equipment was needed by Pink Taxi as mPOS devices were already in place.

In addition to the convenience for all participants in this process - both taxi users and taxi drivers, the important benefits of QR code instant payments also include the speed of transaction and immediate access to funds for payees. The clients of any bank can pay for the taxi service using “IPS Scan” option, while the partner bank of Pink taxi is Komercijalna banka, which is the first bank in Serbia that will enable instant payments for such a large merchant as Pink taxi.

The technology behind it – IPS Point of Interaction

Following the IPS Phase 1 which focused on direct funds transfer via 3 channels (Electronic banking, Mobile Banking, Branch), the central point in Instant Payment Phase 2 is Merchant’ Point of Sale in the whole instant payment system. Phase 2 includes instant payments via QR code, which represents an already fulfilled payment statement (slip) and is the main connection between the buyer and the merchant. The National Bank of Serbia defined two mandatory payment methods that must be supported in a mobile banking application, while the merchant has a possibility to choose which payment method will be used at the point of interaction:

- IPS Show (PULL method)

- IPS Scan (PUSH method)

The central component that connects point of interaction (POI) and buyer (client) with the rest of the Instant payment system is IPS POI Backend.

IPS POI backend is a payment server for transaction initiation from different channels (EFT POS, Android POS, POS Cash register etc.) and forwarding of the payment request to the instant payment system. POI Backend also enables accepting the transaction status and sending the status notification to the POI. Important checks and controls for the transaction data correctness are done at IPS POI Backend.

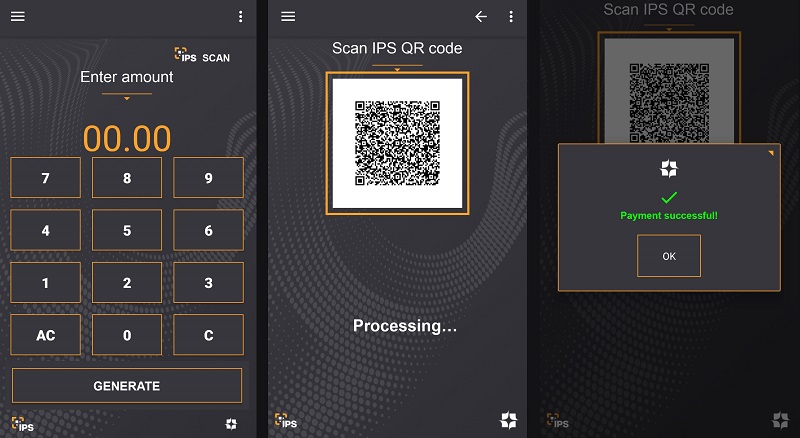

Payments using “IPS Scan” as implemented for Pink Taxi can be completed in 3 simple steps and the merchant has a possibility to generate the reports (different formats) and send them to email addresses.

For more information about the solution, please contact us for a consulting session or a demo.